Community-centred services support residents to build financial resilience

From April to July 2022, community researchers from Lawrence Hill, Bristol, led in-depth interviews with residents, and held co-analysis and co-design workshops with stakeholders, to understand the financial lives of low-income households in their community, explore barriers and enablers to financial resilience and develop solutions.

Even before the current period of high inflation, the Resolution Foundation found that 43% of UK families in the lowest wealth decile would run out of money within one week if they lost their main source of income. With the Bank of England expecting the crisis to worsen, the question of how to help low-income households build up financial resilience to better buffer and adapt to financial and economic shocks, has become even more urgent.

Policy implications

Recommendations to those providing direct services to low-income households - community groups, advice/support organisations, council support - and decision-makers at the local and national level:

1. Listen to residents and connect services

Participants’ financial lives are as complex as their regular lives and they need community-centred holistic support that looks at the larger picture – from childcare to financial services and access to community support – rather than having to navigate insular and inflexible services.

2. More money now – better employment opportunities and childcare in the long-term

Even though interviews were conducted at the beginning of rapidly rising inflation, participants were already struggling with rising food, energy and petrol costs and described the effect it had on their lives – from taking on additional debt to skipping meals to creating mental health issues. More cash is needed urgently in the short-term while in the long-term, childcare and support for training or certification are crucial to get people out of unemployment or precarious low-paid employment and enable them to earn a living wage.

3. Invest in infrastructure: housing, health care, and childcare and support

Overcrowded and outdated housing is a key concern for many participants, creating additional cost by making it impossible to shop in bulk or increasing energy costs due to poor heating. Health issues both increase spending and limit opportunities to gain income for many and over and over parents identified a lack of support for children as a key cost driver and barrier to employment.

4. Strengthening communities and families pays off

Participants rely strongly on informal networks – the local corner shop providing food on credit, a family member stepping in when money runs out at the end of the month, a neighbour supporting with benefit applications and contacts to support organisations. However, a lack of community spaces and support for families is making it harder to build these networks.

Mapping lived experience of financial resilience

Community researchers led in-depth interviews with Lawrence Hill residents where they together mapped out participants’ financial lives: from discussing income, expenses and strategies to cope with financial shocks, to exploring key support, worries and hopes for the future. The community researchers were themselves residents of Lawrence Hill and volunteered for the role based on their own experience of struggling to build financial resilience.

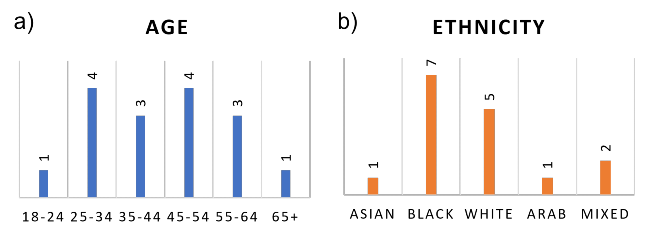

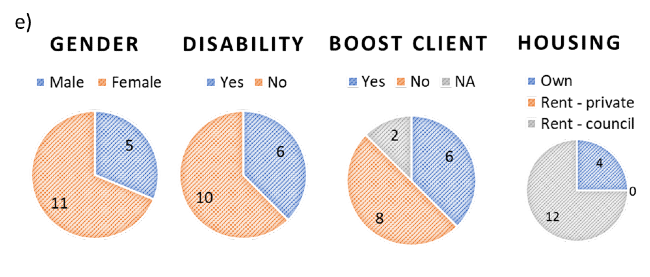

Four community researchers spoke with 16 residents of different ages, backgrounds and experiences (Figure 1). The participatory interview approach and the status of researchers as members of the community, made it easier to build trust and allow participants to speak openly. The researchers debriefed with a partner immediately after interviews and shared what they were learning through regular check-ins.

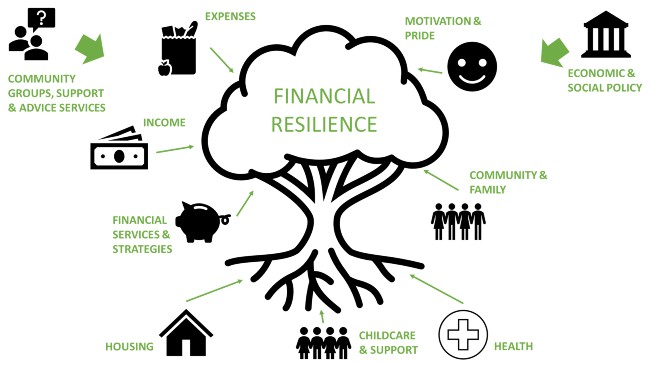

A key finding was the complexity of the financial lives of participants and how diverse factors – infrastructure, financial and social – interacted to build or hinder financial resilience.

Figure 1 | Characteristics of residents interviewed (total = 16) to understand live experience of financial resilience.

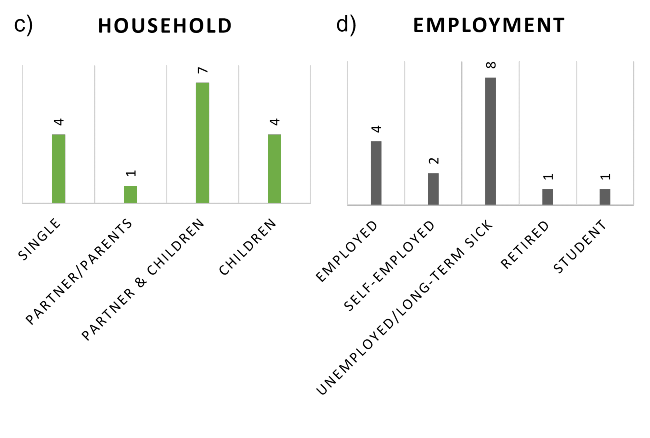

Building a framework of financial resilience

A key finding was the complexity of the financial lives of participants and how diverse factors – infrastructure, financial and social – interacted to build or hinder financial resilience. As more and more interviews were conducted, a framework started to appear that showed how financial and social factors directly affected financial resilience while infrastructure and formal support shaped the environment participants were living and trying to build resilience in (Figure 2).

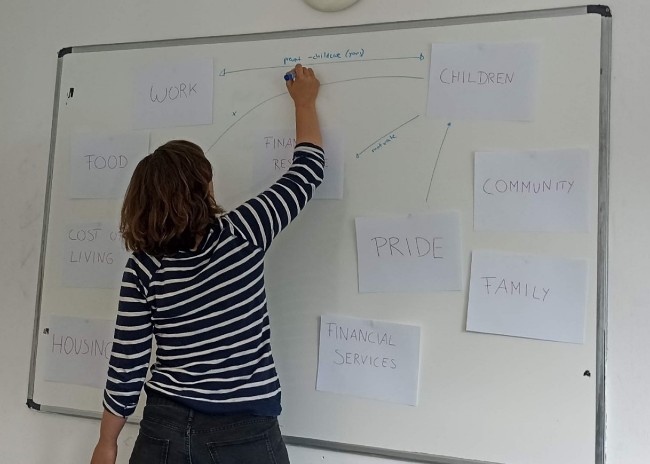

First draft of the framework coming together through joint analysis.

Lawrence Hill, Bristol

Situated in the center of Bristol, Lawrence Hill is one of Bristol’s most vulnerable wards: most households fall into the lowest decile of the Bristol City Council deprivation index, life expectancy is lower and health worse than the Bristol average, it has the 3rd highest crime rate in the city, a third of children live in poverty and their average achievement scores at KS4 are the 6th lowest in Bristol. Historically, a working class white neighborhood, Lawrence Hill now has the highest percentage of BAME residents in the city, many of which are refugees and immigrants from East Africa or South Asia.

Community-centered services

Wellspring Settlement is a charity run for, and led by, the community to enable residents to actively participate in positive, life-affirming activities. It offers a unique space to celebrate, learn, create, develop, relax, socialise and play. From young people to the more mature, from new residents of our locality to those who have lived here all their lives, everyone is welcome.

Boost Community at the Wellspring Settlement, is a collective of advice agencies (debt, benefits, housing and employment advice) set up to deliver services differently and with the mission to empower local people to take control both individually and collectively.

Figure 2 | The final framework of financial resilience as lived by the residents of Lawrence Hill, Bristol, showing how diverse factors - infrastructure, financial and social - interact to build or hinder financial resilience.

Within each factor, researchers crystallized key insights to show how they connect to each other, as well as shape ideas for support.

Expenses: Increasing costs (especially energy and petrol) are creating stress and pressure for everyone while, for parents especially, food shopping is also an increasing cost burden.

Income: Current income – both for those who work and those unable to – is not sufficient and/or not reliable. To increase income, residents need better childcare and support to gain new skills or recognize existing certifications.

Financial Services & Strategies: Managing a tight budget requires lots of effort, use of multiple financial services and help from community and family. Credit (credit cards, overdraft, informal loans) helps provide needed resources and safety, but can create extra costs (e.g. repayment fees). Savings make people proud – many already save some and would like to save more.

Motivation & Pride: Pride – for example in providing for children – keeps participants going and motivates them to manage their money even when it’s stressful, but it can also be a barrier to getting support.

Community & Family: A strong community or family gives direct support (e.g. loans), provides participants with information about support available, and helps them feel less alone and stressed.

Housing: Inappropriate housing (e.g. too small, not well built, no community space) increases expenses (e.g. high energy costs, no food storage space), impacts health, and creates loneliness. Owning your own house creates a sense of pride for most, but can also create financial pressure.

Health: Health issues create additional costs, can affect your ability to manage your finances, and make it difficult to work and earn income.

Childcare & support: Children are a source of pride and can help or hinder people from building a community. They can also create extra costs for which there isn’t sufficient support (e.g. school uniforms, transport). A lack of affordable and suitable childcare is a key barrier for participants, especially mothers, to work and gain income.

Community Groups, Support & Advice Services: Many participants are already getting some support, especially on housing and bills. However, barriers to support can be pride, a feeling of not belonging, a lack of information, and language and cultural barriers.

Social & Economic Policy: People feel: not listened to, especially around community and housing issues; that many health and support services have closed; that there is not enough support for parents and children; and that not enough is being done to reduce cost of living and provide opportunities for better incomes (e.g. through training).

Creating community-led and community-centred services to support financial resilience in Lawrence Hill

Having developed a deep understanding of the enablers and barriers to financial resilience in their community, researchers then participated in a series of co-design workshops with Boost Community, the Wellspring Settlement and outside organisations including Great Western Credit Union, to share their learnings and develop solutions.

Reviewing their findings and participants’ priorities, the team decided to focus on three key issues:

- strengthening the links between Wellspring Settlement services and reducing barriers to access them;

- providing more support to parents;

- elevating community voices in decisions around housing.

Community researcher Moustapha Ahmed explains the research findings to a team from Great Western Credit Union.

In response to these focus areas:

• Community researchers and the Wellspring Settlement communications team used the framework to develop new communication materials that make it easier to find and understand available services, especially to those for whom English is a foreign language.

• Boost Community, the Wellspring Settlement community team and the community researchers are organising an Open Day for residents to learn about the research, get to know available services – children’s activities, community groups, job support and debt advice – and get the support they need in a welcoming and fun atmosphere.

• Boost Community is planning to pilot integrating their weekly drop in sessions with a community café to encourage more peer support and exchange. They are also exploring a Somali language drop in and a drop in especially for parents.

• Community researchers met with Wellspring Settlement management to discuss how the Settlement might continue to advocate for the housing needs of Lawrence Hill and centre community voices.

Further information

This project was a collaboration between Boost Community and the University of Bristol, and funded by the Brigstow Institute with additional funding for a community event through the ESRC Festival of Social Sciences.

This is the first of three case studies in the area of community-based research into financial resilience. For related research please visit the Personal Finance Research Centre (PFRC), University of Bristol.

Authors

Anne Angsten Clark, Sharon Collard, Caitlin Holme and Daniella Jenkins (University of Bristol); Moustapha Ahmed, Claudia Dimitriu, Elmi Duucale and Iqbal Osman (community researchers); Lisa Dora and Hari Ramakrishnan (Boost Community).