From mothers for mothers – supporting financial resilience through user-centered services

Mothers are often primarily responsible for managing the household budget on limited resources. The question of how to help low-income mothers build up financial resilience to better buffer and adapt to financial and economic shocks, has become even more urgent.

Mothers are often primarily responsible for managing the household budget on limited resources. This leaves them at higher risk of poverty and less likely to have financial buffers such as savings, insurance or affordable credit. According to the Office for National Statistics (ONS), increasing inflation is now adding to the pressure for parents and a recent financial tracker found that 37% of single parents were in serious difficulties with their finances. The question of how to help low-income mothers build up financial resilience to better buffer and adapt to financial and economic shocks, has thus become even more urgent.

From May to October 2022, community researchers – mothers themselves – led in-depth interviews with mothers in Bristol, and held co-analysis and co-design workshops with stakeholders, to understand the financial lives of mothers, explore barriers and enablers to financial resilience and develop solutions.

Policy implications

Recommendations for those providing direct services to mothers and parents – from financial services providers to community organisations and council support – and decision-makers at the local and national level:

1. Support better parental leave and childcare

Maternity leave and subsequent economic cost of childcare as well as reducing working hours to care for children are the main barriers for mothers to build financial resilience. More support is urgently needed to help buffer the financial loss of taking time off work for caring responsibilities and to reduce the cost of childcare, but also to make it easier and more common for parents to share these responsibilities.

2. Design for women

Mothers frequently have different professional trajectories from men, prioritise spending differently on account of responsibilities for children and need different support to build financial resilience. Financial advice and services need to account for this and be designed with the needs and priorities of mothers in mind – for example offering ways of saving for the future that provide flexibility to adapt to needs in the present.

3. Encourage conversations

Mothers often don’t speak to others about their finances – couples might not have open conversations around income, expenses and longer-term effects of part-time work; mothers can hesitate to speak openly between each other about how they’re managing and women can be reluctant to reach out to financial service providers with financial issues due to fear that this might reduce their chances of qualifying for financial products in the future. Changing this holds power in spreading financial responsibilities more equally within families and offering the right kind of support.

Mapping mothers' experience of financial resilience

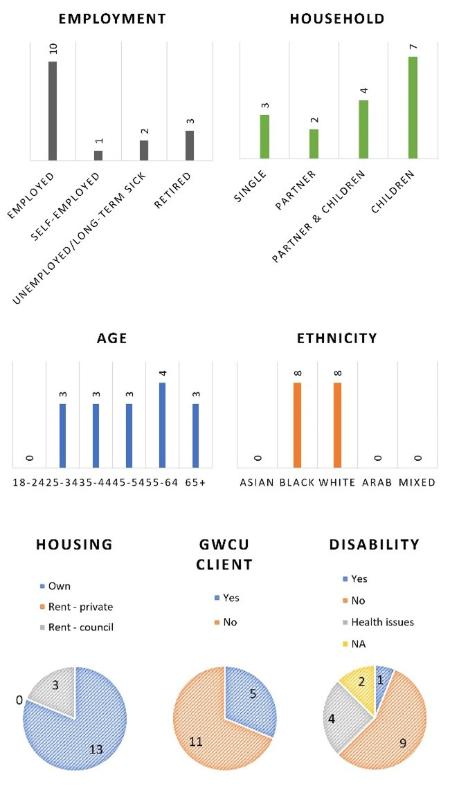

Three community researchers – mothers themselves – led in-depth interviews with 16 mothers from around Bristol where they together mapped out participants’ financial lives: from discussing income, expenses and strategies to cope with financial shocks, to exploring key support, worries and hopes for the future. The participatory interview approach and the status of researchers as mothers themselves made it easier to build trust and allow participants to speak openly.

Figure 1 | Characteristics of mothers interviewed (total = 16) to map lived experience of financial resilience.

“Speaking to other mothers about how they manage was eye-opening. I’ve adopted some of the strategies I learned from participants in the interviews, for example setting all my bills to go out on the 1st, and it’s made managing monthly expenses a lot less stressful.”

Community researcher

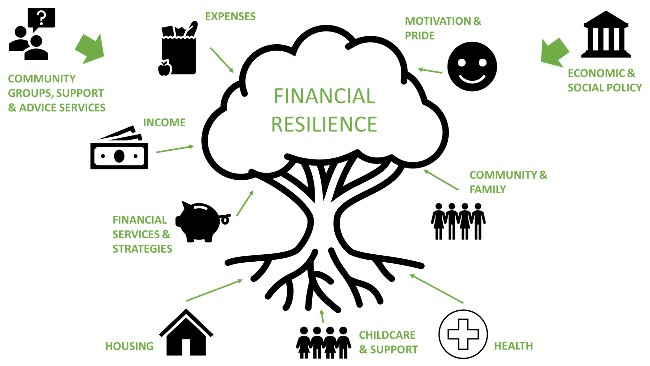

The team analysed interviews together, building on a framework developed in a parallel community research project that identified how diverse factors interact to build or hinder financial resilience:

- Infrastructure factors – stable housing, good health, and accessible childcare – that build the foundation of financial resilience;

- Financial and social factors – manageable expenses, a reliable and sufficient income, targeted financial services, a source of motivation and pride and a supportive community – that allow resilience to grow;

- the broader support environment factors – economic and social policy as well as offerings of community groups, support and advice services (Figure 1).

Figure 2 | A framework of financial resilience showing how diverse factors - infrastructure, financial, social and environmental - interact to build or hinder financial resilience.

Key insights

Focusing on the situation of mothers specifically, the team crystallised key insights on the factors that were most helping or hindering from building resilience:

Constantly juggling

Most mothers receive income from several sources (e.g. from multiple jobs or pensions, through tax credit and other government support, contributions from family) – this can be welcome as it allows for flexibility, but often is just necessity as no one source is sufficient. Many work part-time or would like to be part-time, and highlighted that they enjoy (or would enjoy) spending time with their children, but also that this causes financial difficulties.

To manage expenses, and provide for their children on low and sometimes variable incomes, mothers use a variety of financial services and strategies. While successful management can be a source of pride, it also creates stress for many, especially with rising costs, and is detrimental to the mental health of some. Strategies widely used include:

- Bills first using strategies such as direct debits, looking at the account balance only when bills have gone out or paying bills in advance.

- Strict budgeting with the help of multiple accounts, spreadsheets, apps, lists, cash accounting and an attitude that mothers describe as “staying within one’s means”, “cutting down on non-essentials” and “you got to do what you got to do”. For many, food shopping and cooking are important strategies to manage expenses – from buying and cooking in bulk, to getting discounts, reducing consumption of meat and other expensive items or buying reduced items at last sell by date.

- Credit cards for everyday emergencies or extra security. Some avoid credit cards altogether or only use them for extra purchase security and pay off expenses right away while others appreciate the buffer and security credit cards can provide.

- Avoid loans except for larger purchases (e.g. mortgage, car) that cannot be put off and pay debt off as soon as you can. Being mortgage and debt free means freedom.

- Savings are important. Saving for their children’s needs – in cash or separate accounts - and for goals - from birthday presents to after school activities – is a priority for almost all, even if money is tight elsewhere. Most also save for emergencies and many for larger goals, although the latter is put on hold when day to day expenses take priority. Attitudes about saving for the future differ between those for whom that feels too far away, those that want to save up but feel unable to prioritize it alongside more urgent demands and those who are able to invest in pensions and insurance for later life.

Shouldering responsibility

Providing for their family, being a role model and wanting their children to succeed are important motivations. However, it can also be a source of worry and stress. A lack of affordable and convenient childcare is a major barrier to gaining more income for many and when describing how they manage finances, many mothers – independent of their partnership status – assume most of the responsibility of childcare, children’s expenses and the financial impact of having children (e.g. taking time off or working part-time). Fathers were mentioned as contributing by paying child support (if separated) or picking up the “larger bills” (e.g. for housing). These arrangements are often based on implicit assumptions around responsibilities, roles and expenses, rather than transparent discussions and calculations between partners.

Getting support and advice

Community and family are a major source of support, providing direct support by donating items or stepping in for larger expenses; offering advice and financial education; and helping out with childcare. This creates issues for those who don’t have a strong family or support network, especially as there is little uptake of more formal advice and low awareness and expectation of what support might or should be available.

Some point to a gap of “good old fashioned in person” and “safe and comfortable” financial advice and services for women, for example around pensions, investments and financial planning for those who only have small amounts of money to put away, how to handle finances in case of divorce or how to navigate the UK system for recent immigrants.

Collaboration and co-design

Great Western Credit Union (GWCU) is a mutual, financial co-operative that is owned and operated by its members and aims to provide fair, inclusive financial services that strengthen local communities. Mothers make up the majority of GWCU customers: In a recent survey, 71% of GWCU loan members who responded were women who have children under 18 living with them and nearly half (46%) were single parents.

Community researchers

The research was conducted by three community researchers:

Valerie - a retired social worker, mother of two and grandmother of five. Valerie joined the project to enhance her interviewing skills, learn about her own financial resilience and from other women how to best manage her finances.

Rahana - Valerie’s daughter, a single mother of two and a college tutor. Having received support from GWCU herself in the past, Rahana decided to be a community researcher to give back to GWCU and other mothers.

Claire - marketing lead at GWCU and mother to three sons. Claire got involved in the project to learn new skills and to get insight into the financial barriers faced by mothers to better support and communicate with them.

Community-based research

This is the second of three case studies in the area of community-based research into financial resilience. In the first, we collaborated with Boost Community at the Wellspring Settlement, Bristol to explore how community-centred services could help build financial resilience with and for residents of Lawrence Hill, Bristol.

“Society makes it out as if men are managing everything, but it’s actually Mums. They’re doing it all”

Community researcher in co-analysis workshop

How to support mothers’ financial resilience through community-centered financial services

Having developed a deep understanding of the enablers and barriers to financial resilience for mothers, researchers shared their learnings with GWCU and together developed potential solutions in a co-design workshop.

Reviewing their findings and participants’ priorities, the team decided to focus on three key issues:

- Positioning GWCU as a partner to mothers and showing how the institution values and centers mothers.

- Encouraging safe and honest conversations about finance between mothers, between mothers and their partners, and between mothers and GWCU.

- Supporting mothers to save for their goals both in the present and the future.

In response to the focus areas, three ideas were developed:

- An online mum’s hub that could include advice from mothers for mothers, stories from GWCU mothers, information about GWCU services for mothers and in-person advice available, training for mothers to become “money mates” to each other and tools to get conversations about money started, and opportunities to get involved with GWCU activities and shape strategy.

- Parent-oriented savings products such as savings jars for parents that help saving up for specific events (e.g. birthdays, Christmas, school start) as well as longer term goals, opportunities to sign up for automated savings from child benefit (a product that already exists for loans through the GWCU Family Finance Plan), and accounts that combine short-term emergency saving and longer-term savings.

- Financial planning and products to help parents plan for parental leave such as 1:1 appointments to discuss budgeting, savings plans and interest-free loans.

GWCU is currently looking for avenues to develop these further. Community researchers together with the GWCU team are also organizing a discussion event for research participants and policy stakeholders to discuss the findings from this research, collect their feedback, ideas and suggestions and connect mothers to each other.

Further Information

This project was a collaboration between Great Western Credit Union and the University of Bristol, and funded by the Research England Policy Support Fund.

For related research please visit the Personal Finance Research Centre, University of Bristol.

Authors

Anne Angsten Clark, Sharon Collard, Sara Davies (University of Bristol); Rahana Davis, Valerie Davis, Claire Royall, James Berry (community researchers / Great Western Credit Union)

Policy Report 82

From mothers for mothers supporting financial resilience through user-centered (PDF, 1,157kB)

Contact the researchers

Claire Royall, Great Western Credit Union: clairer@gwcu.org.uk