Definancialisation and Workspace Regulation as a Public Health Policy Tool

One of the most pressing issues policymakers, business groups, and academics face in the context of the post-COVID-19 recovery is how the economy can become more resilient to similar future challenges. Achieving resilience and sustainability in times of health crises requires a better understanding of social and economic conditions that shape workplace and living conditions.

Even before the ongoing pandemic, it has been well-established that broader social conditions and broader economic policy choices play a key role in public health outcomes. Yet, it is relatively understudied how financial insecurity negatively impacts socio-economic conditions, which ultimately determine public health outcomes.

Our research sheds light on how the financialisation of the economy and society should be considered as a key driver of public health. The purpose of this policy briefing is to summarise how the financialisation of the business (and broader economic) environment, i.e., the dominant influence of financial actors and institutions over the real economy is growing continuously, shapes workplace conditions and the production process, which, in turn, are instrumental for public health outcomes, aiming to offer practical insights for policymakers and firms.

Policy recommendations

• For businesses, coping with rising financial commitments via downsizing workspace might seem a viable short-term option but limits their ability to adapt during health crises where social distancing is essential.

• Trade unions and employee organisations need to take into account how individual financial commitments affect employees risk perception and how public health is currently linked to occupational health.

• Central governments should understand how policies towards the definancialisation of firms, households, and pension funds can also have significant positive effects on public health.

• Local governments should rethink regulations about rent ceilings and minimum workspace sizes as a means of improving occupational and public health.

Key findings

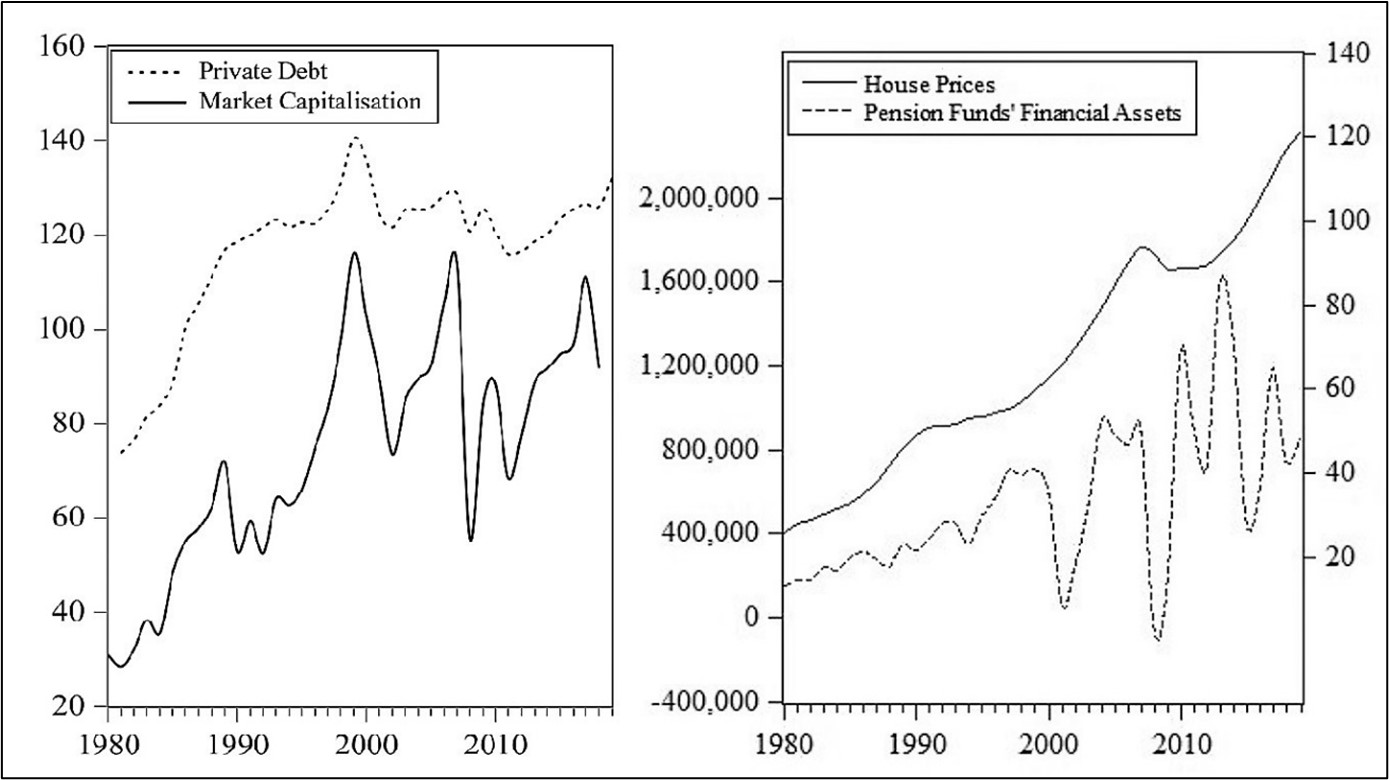

• Despite varying economic conditions across countries and different regions of the world, it is well documented that the global economy is becoming increasingly financialised.

• Over the last decades, increased business debt repayment commitments and the mortgage debt-fueled real estate affordability crisis has increased non-financial corporations’ overhead financial commitments dramatically. Hence, managers commonly counterbalance these by cutting down more flexible costs, including real estate rents, which is likely linked to smaller workspaces.

• Rising financial commitments for households induces employees to work in multiple jobs to cope and these pressure may in turn lead them to return to work while their health conditions might not be appropriate yet.

• Older employees are pushed to delay their retirement or return to work after retirement due to financial insecurity that come from risky, high-return financial instruments by their pension funds.

• Overall, interventions that take into account how financial pressure affects firm management and employees is fundamental for a sustainable post-COVID recovery.

Further information

Gouzoulis, G. and Galanis, G. (2021). ‘The Impact of Financialisation on Public Health in Times of COVID-19 and Beyond.’ Sociology of Health & Illness, 43(6), 1328-1334. https://doi.org/10.1111/1467-9566.13305

Authors

Dr Giorgos Gouzoulis (University of Bristol, School of Management), Dr Giorgos Galanis (Goldsmiths, University of London, Institute of Management Studies)

Policy Briefing 113: Dec 2021

Definancialisation and Workspace Regulation as a Public Health Policy Tool (PDF, 2,356kB)